思考FIRE

外國早期提倡financial independent retire early,簡稱FIRE。Youtube 也有不少以此為題目的題材作講解。而我也覺得,人在職場到了一定期間也應該思考如何作此財自的規劃。

FIRE說易行難,簡單一點是要做下面幾個步驟:

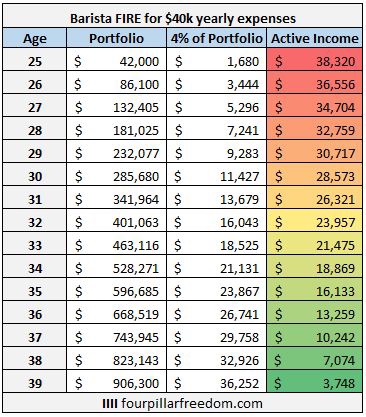

- 計算出每月支出,從而知道每年總支出。

- 把這總支出乗25便得出需要多少市值的資產。假設每月支出要三萬元,一年便要三十六萬,乗25等如需要900萬資產。

- 當今天已成功儲得這個數,只要每年只拿4%出來生活便是每月三萬元的生活開支了。

真的這樣簡單?今天的三萬不等如十年後通脹了的三萬元所以應考慮加入通脹的百分點,例如是3~5%。而到實在操作時,其實以六厘或以上為目標會更可取。

試想想,用上面的例子,當我們終於有900萬的資產,便可以以此方式定期提取生活費。有機會爭回時間後,還可選擇做其他的工作來增加收入呢。